[MUSAI] Statistics Based Analysis of the Korean Localization Market Part 2. Recording Studios

In the previous article, we discussed the Korean translation business based on the official statistical data provided by the Korean Statistical Information Service. As promised, we will continue to look deep into the Korean localization market, focusing on the recording industry this time around.

In November 2020, we’ve released an article regarding ‘Statistics Based Analysis of the Korean Localization Market – Recording studios’ through our blog. Please refer link below.

It was an article written based on 2018 statistics data from the Korean Statistical Information Service. In this article, we prepared an article with the updated data of 2019 statistics data this time.

Prologue

The statistics in this article are based on companies registered as “Audio Recording Studios”. Therefore, statistics from the cases below have been omitted from this article.

Companies providing recording services that are not registered as “Audio Recording Studios”

Companies providing recording services that are not registered as “Audio Recording Studios”

Recording businesses run by individuals and/or are unincorporated.

Recording businesses run by individuals and/or are unincorporated.

Additionally, we would like to inform you that the statistics presented in this article are based on accumulated data from 2019. The source of the statistics can be found in the link below.

https://kosis.kr/statHtml/statHtml.do?orgId=101&tblId=DT_1KB9003&conn_path=I3

The current state of the Korean recording studios

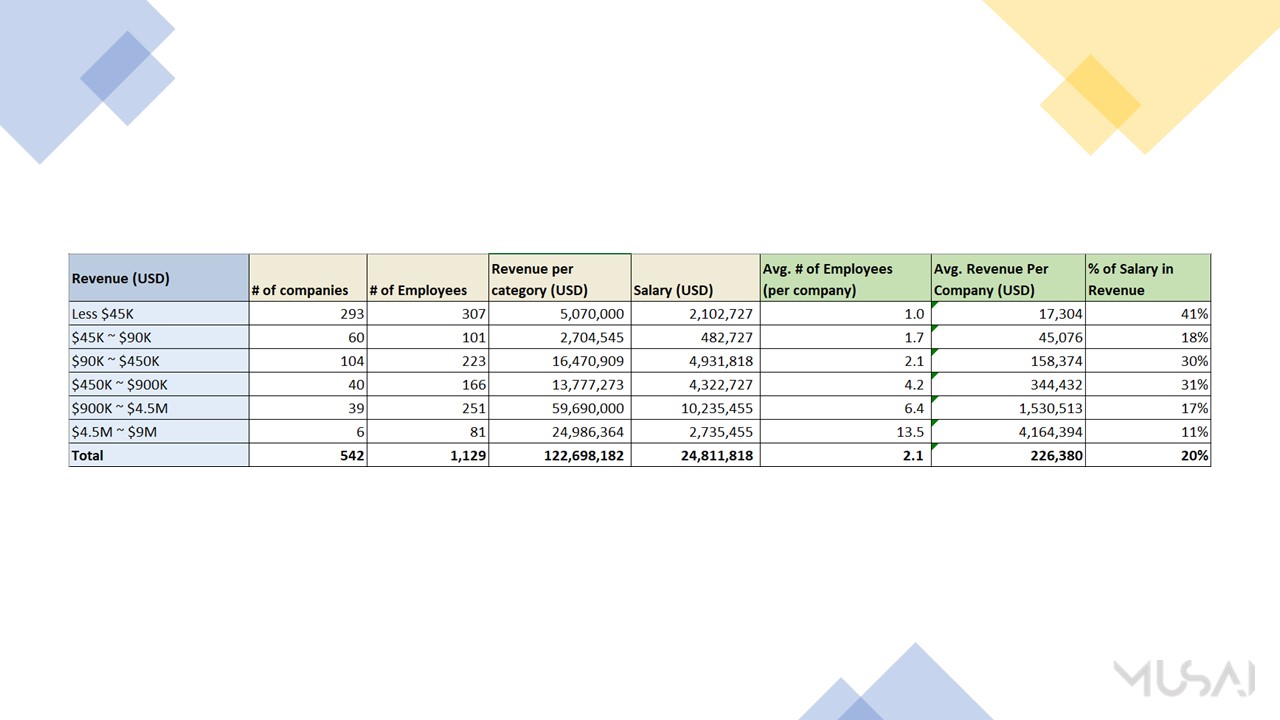

The total revenue of the Korean recording studios amounts to roughly 123 million dollars (112 million dollars on 2018). Total numbers of studios are 542 companies (529 companies on 2018).

Thus, total revenue is growing at about 8%, and number of studios are slightly growing at about 3%.

Depending on the statistical method, the deviation can be very large. Please consider this numbers are only based on statistics data from The Korean Statistical Information Service.

Four interesting topics chosen by Musai

Musai Studio picked four meaningful topics and transformed the numbers of each statistic into diagrams to provide visual feedback and discuss in more detail. Here’s summary of each topic.

Summary

- The largest number of recording companies lay within the range of an annual revenue of less than 45k dollars. (Same as 2018)

- 86% of the Korean recording business are located in Seoul and capital area. (Same as 2018)

- Companies with an annual revenue of between 900k and 4.5 million dollars made up the greatest portion in total annual revenue of the Korean recording business. (Same as 2018)

- The average number of employees per company is 2.1 and the average annual revenue per company is about 226k dollars. (Similar as 2018)

Here’s detail analysis of each part.

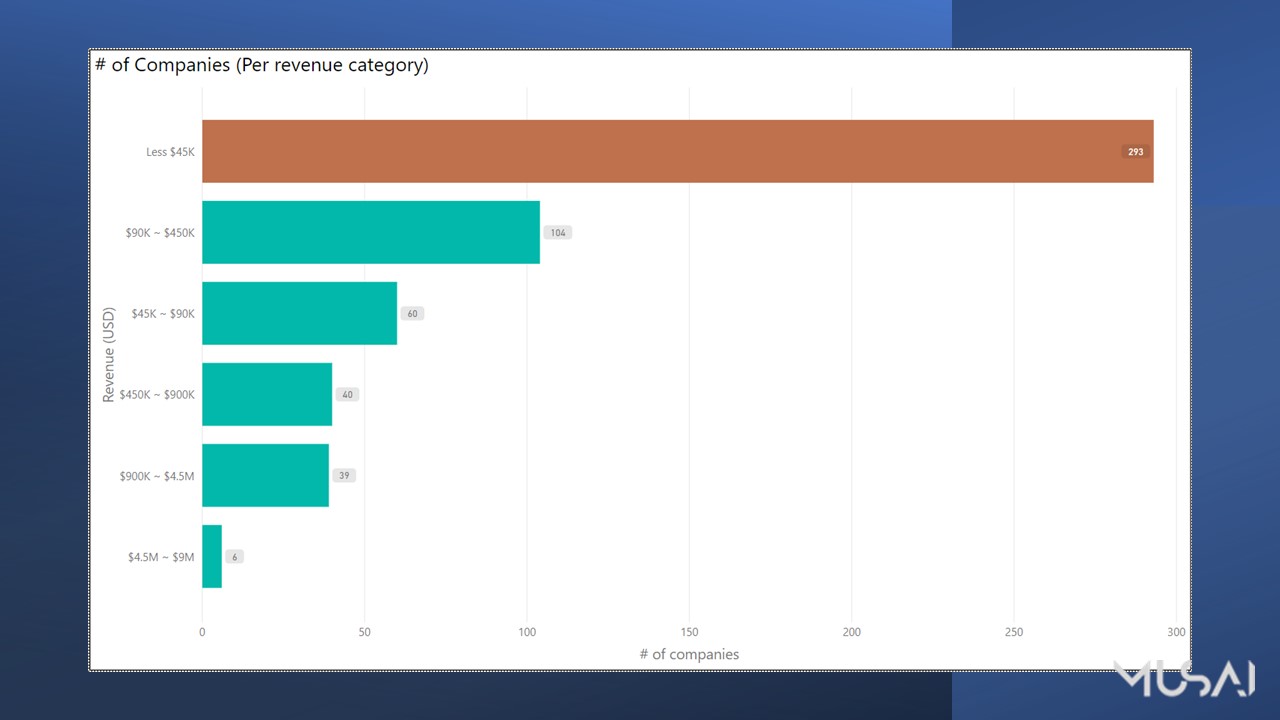

[Part 1. The number of studios] How many recording studios are in Korea? Let’s figure it out by each revenue scale!

There are 293 studios with an annual revenue of less than 45k dollars are largest portion. If included studios with an annual revenue betweeon 45k to 90k dollars, these are account for 65% of the total number of Korean recording studios. That means there are so many small studios is Korea. A majority of the studios are small businesses.

On the contrary, the number of businesses with revenue of more than 450k dollars has more than doubled from 39 to 85 compared to 2018. In particular, the number of large-scale businesses with revenue of “4.5M to 9M dollars” has also increased from three to six.

This is expected to be affected by media recording market due to the expansion of the OTT such as Netflix. Also, higher revenue is expected from 2020 even data is not revealed yet.

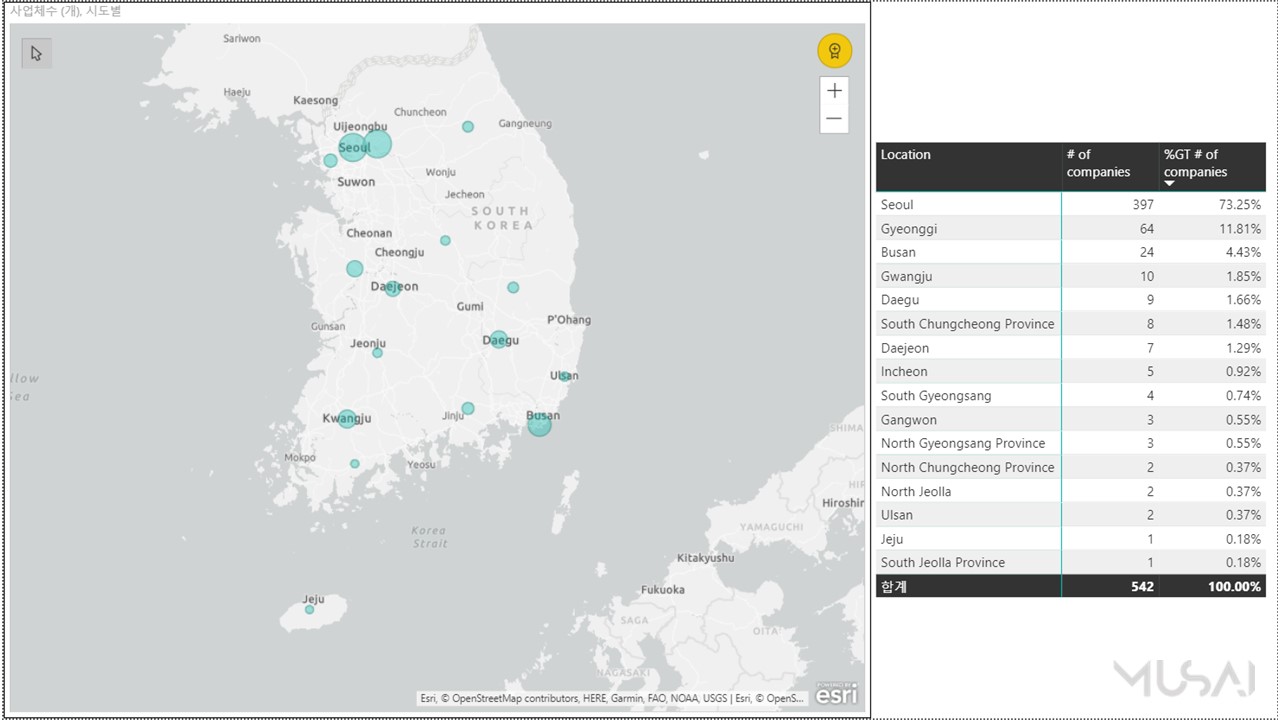

[Part 2. Distribution by city and province] Distribution of Korean recording studios by region.

86% of the total Korean recording studios are located in Seoul and capital area (Gyeonggi, Incheon). In areas other than Seoul and the capital area, distributed in the order of Busan and Gwangju.

Due to the nature of the recording business, it show that studios have no choice but to settle in Seoul and the capital area, where customers are concentrated.

[Part 3. The portion of the total revenue] Which scale of recording studios are taking the biggest portion of the total revenue in Korea?

Studios with an annual revenue of between 900k and 4.5 million dollars, which account for only 3% (39 studios) of the total number of recording studios in Korea, made up the largest portion of the pie at 49% of the total annual revenue. For your reference, the average annual revenue of the studios who 900k and 4.5 million dollars is 1.5M dollars.

Meanwhile, companies with an annual revenue of less than 45k dollars, which are the most in terms of the number of the recording companies in Korea (293 studios), account for 4% of the total annual revenue.

[Part 4. The average number of employees per studio] 2.1 employees in average per studios.

The higher the revenue, the higher the number of employees in translation industry.

In the case of the recording studios, revenue and the number of employees increase proportionally to less than 900K dollars. However, if it is more than 900K dollars, it does not increase proportionally. For example, average employee is only 13.5 for the studios who revenue scale is 4.5M to 9M dollars.

This can be expected to be due to several factors like the following.

- Hire contract employees: Considering that the salary cost ratio of businesses with more than 900k dollars is in the 10% range, studios hire contract employees than permanent to handle the project on the peak period (e.g., freelance artistic director or audio engineer).

- Outsourcing to other studios: Major Korean recording studios outsource with other small studios if recording facilities are fully booked.

- Businesses other than recording: Running voice-related businesses such as voice recognition, TTS, STT, and STS which recently popular.

Epilogue

It may seem insincere by recycling the topic from two years ago, but we thought it was also meaningful to record the figures that changed every year. In addition, since it is an analysis result that relies only on data from the Korean Statistical Information Service, detailed figures may not be accurate, however it seems that it is enough to grasp trends and business flows in Korean localization industry.

As the Korean localization market expands and interest from the global market is increases, we think more of these kinds of data will be needed. We hope that our attempts will help those interested in the Korean localization market in the future.

- For those who need the chart in this article, share the chart file in PDF file format. Feel free to use it, but please disclose the source of the chart.

** Did you enjoy our article? Please click subscribe and share the story.

BOOST YOUR PLAY! Musai Studio