[MUSAI] Statistics Based Analysis of the Korean Localization Market Part 1. Translation Business

In November 2020, we’ve released an article regarding ‘Statistics Based Analysis of the Korean Localization Market’ through our blog.

It was an article written based on 2018 statistics data from the Korean Statistical Information Service. In this article, we prepared an article with the updated data of 2019 statistics data.

It’s actually quite difficult to find data and research associated with the Korean localization market as compared to other industries, since much of this information exists only as estimations. Therefore, we will analyze the Korean translation business based on the data announced by the Korean National Statistical Office.

Prologue

Before diving in, we would like to inform you that the statistics in this article are solely based on companies registered as “Translation and Interpretation services”. Therefore, statistics from the cases below have been omitted from this article.

Companies providing translation services that are not registered as “Translation and Interpretation services”

Companies providing translation services that are not registered as “Translation and Interpretation services” Translation or interpretation businesses run by individuals and/or are unincorporated

Translation or interpretation businesses run by individuals and/or are unincorporated This data is included not only translation but also interpretation business

This data is included not only translation but also interpretation business

If we were to include the cases above, the actual number of translation businesses would be roughly twice the size of the current statistics. For example, statistics show that there are a total of 712 companies in this domain, but in actual practice, we can estimate roughly a thousand businesses. Furthermore, we would like to remind you that the statistics presented in this article are based on accumulated data from 2019. The source of the statistics can be found in the link here:

https://kosis.kr/statHtml/statHtml.do?orgId=101&tblId=DT_1KB9003&conn_path=I3

The current state of the Korean translation business

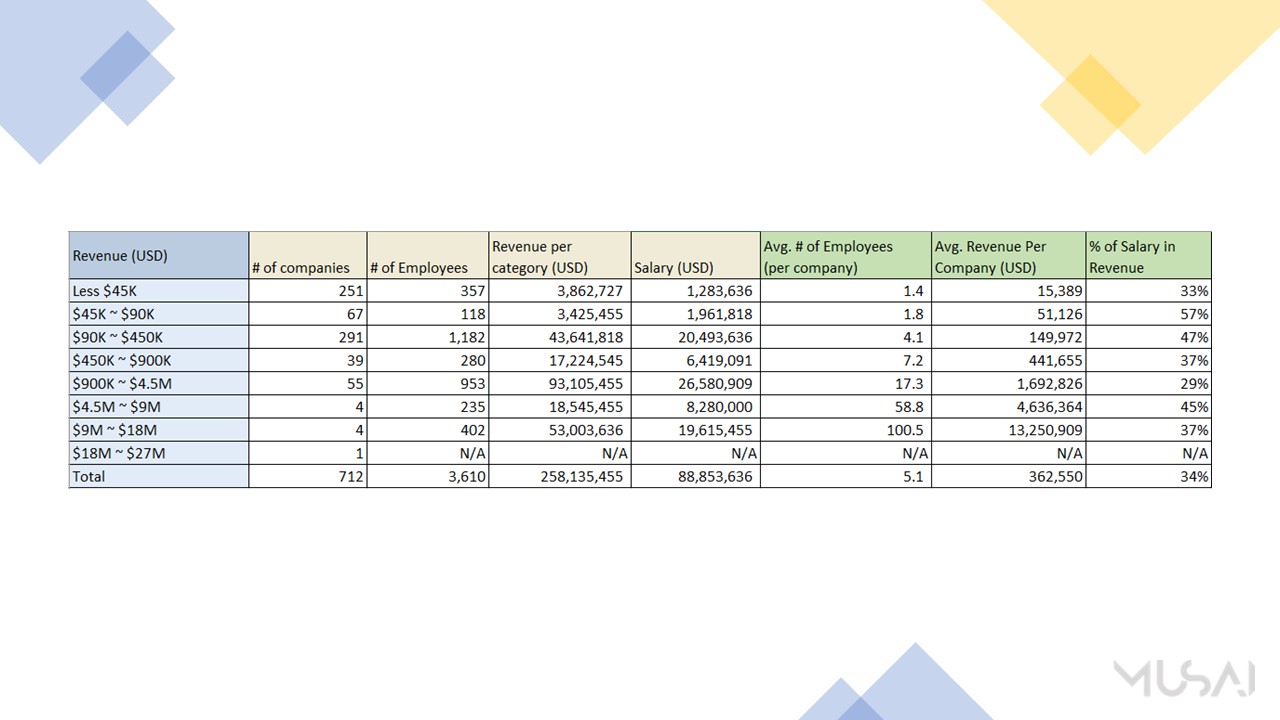

The total revenue of the Korean translation business amounts to roughly 258 million dollars (243 million dollars on 2018). Total numbers of companies are 712 companies (674 on 2018). Thus both revenue and number of companies are growing at about 6%. Depending on the statistical method, the deviation can be very large (e.g., Machine translation or Natural language process business were not included this data. Please consider this numbers are only based on statistics data from The Korean Statistical Information Service.

Four interesting topics chosen by Musai

Musai Studio picked four meaningful topics and transformed the numbers of each statistic into diagrams to provide visual feedback and discuss in more detail. Here’s summary of each topic.

Summary

- The largest number of translation companies lay within the range of an annual revenue of ’90K ~ 450K’ dollars. (On 2018, less than 45k dollars were largest number of companies.)

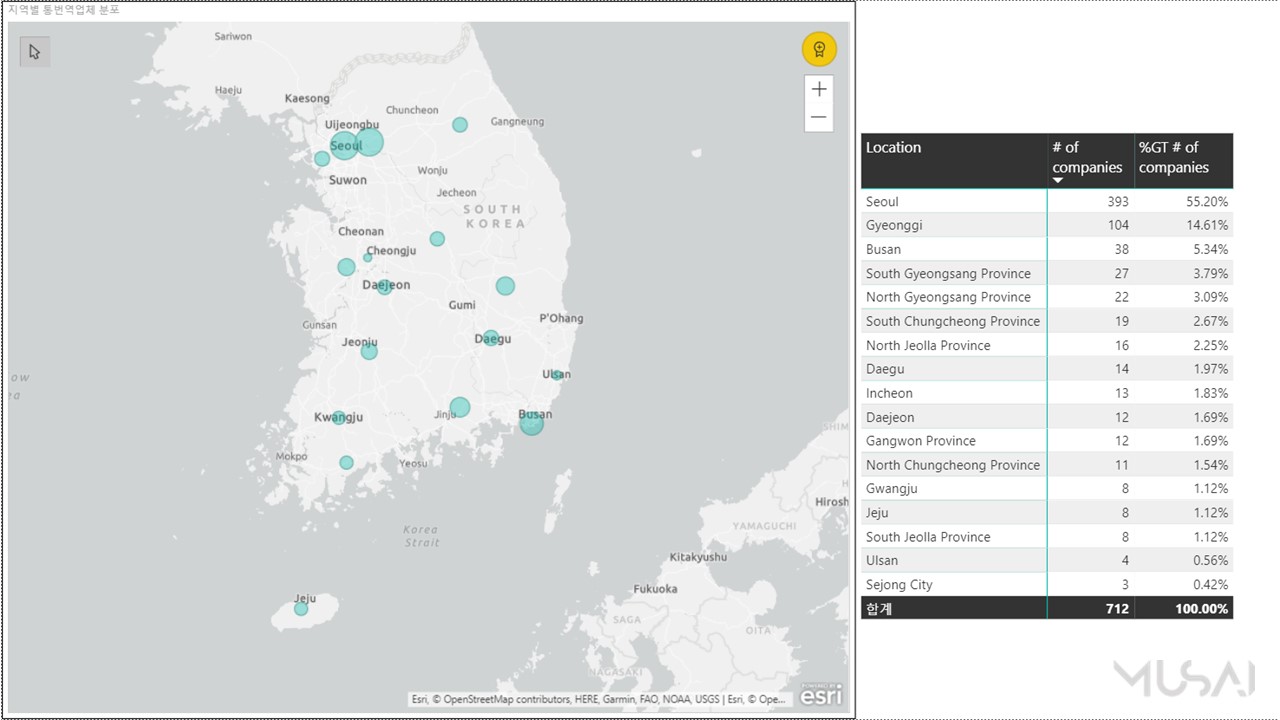

- 72% of the total Korean translation business is located in Seoul and capital area. (77% on 2018)

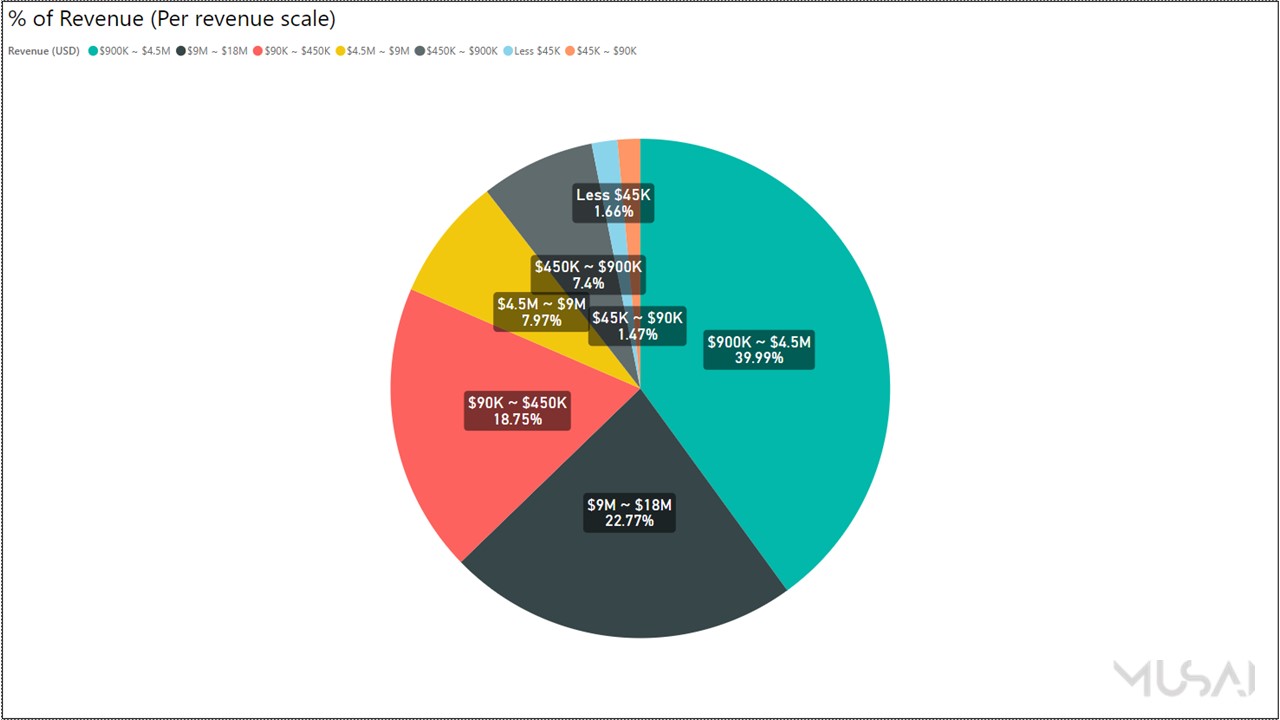

- Companies with an annual revenue of between 900k and 4.5 million dollars made up the greatest portion in total annual revenue of the Korean translation business. (Same as 2018)

- The average number of employees per company is 5 and the average annual revenue per company is 362k dollars. The average ratio of labor cost to revenue is 34%. (Similar result as 2018)

Here’s detail analysis of each part.

[Part 1. The number of companies] How many translation companies are in Korea? Let’s figure it out by each revenue scale!

The total number of companies is 712, of which 291 companies with revenue between $90k and $450k account for about 40% of the total. Following this, companies with sales of ‘Less $45k’ account for 35%.

For reference, in 2018, companies with ‘Less $45k’ accounted for 40%.

Not only the number of companies but also revenue by companies are showing slight growth compared to 2018.

[Part 2. Distribution by city and province] Distribution of Korean translation companies by region.

72% of the total Korean translation business is located in Seoul and capital area (Gyeonggi, Incheon). In areas other than Seoul and the capital area, distributed in the order of Busan and South Gyeongsang province.

[Part 3. The portion of the total revenue] Which scale of translation companies are taking the biggest portion of the total revenue in Korea?

Companies with an annual revenue of between 900k and 4.5 million dollars, which account for only 8% of the total number of translation companies in Korea, made up the largest portion of the pie at 40% of the total annual revenue. With this revenue scale, it can be assumed that these companies are in a period of financial stability with regular clients.

Companies with an annual revenue of between 9 and 18 million dollars account for 23% of the total annual revenue. The detail of companies in this category is not disclosed and cannot be verified, but it is predicted to be a Korean branch of MLV (Multi-language vendor) or a localization company of a specific industry (i.e Defense, Patent, etc.).

[Part 4. The average number of employees per company] 5 employees in average, The wall of $100k (around 0.1 million KRW) revenue per employee.

As expected, the higher the revenue, the higher the number of employees within an organization. Interestingly, companies with up to 90k dollars of revenue only have less than 2 employees on average, which means they are a so-called ‘one-man vendor’ dealing with all translation processes by oneself like ‘one-man band’.

The average number of employees per company is 5.1 and the average annual revenue per company is 362k dollars. Thus, average revenue per employee is around 75k dollars. In the Korean translation industry, there is a tendency to set the target revenue per employee at 100 k dollars, and statistics show why 100 k dollars is calculated as the target. That means companies has enough profit to maintain business once get the revenue 100 k dollars per employee.

Localization is an inevitable process for products and services targeted to the global market.

We hope this article will be useful for those who need insights into the Korean localization industry or select Korean localization companies to work with for your future projects.

We analyzed the Korean translation and interpretation companies as a first article of ‘Statistics Based Analysis of the Korean Localization Market’. We will be back with the much sought-after analysis of the Korean recording studios in the next article of this series.

- For those who need the chart in this article, share the chart file in PDF file format. Feel free to use it, but please disclose the source of the chart.

** Did you enjoy our article? Please click subscribe and share the story.

BOOST YOUR PLAY! Musai Studio