[Musai Studio] 2021 White paper on Korean Games (Latest trend of the Korean Game Market)

The Korean Creative Content Agency publishes a white paper on Korean games every year. The most recent version was published and distributed in Dec, 2021.

The biggest news It included showed that South Korea has risen to fourth place internationally in the global game market this year. We have summarized the main points from the game white paper below. Please note the trend data contained refers to data from 2020.

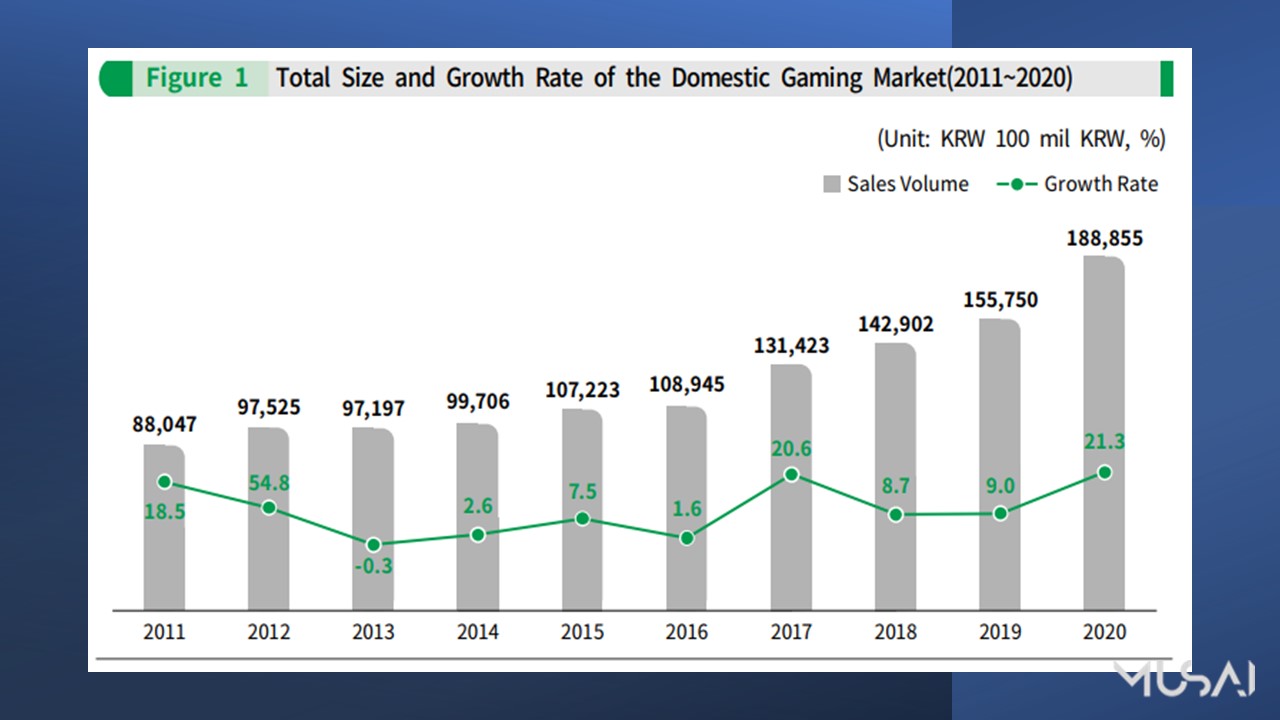

A 21.3% increase in the domestic gaming market in 2020

The domestic gaming industry has gradually increased in the past 10 years, except in 2013 when the market slightly contracted. It showed significant growth in 2020 due to various environments like the Covid-19 crisis.

Korea ranked in the 4th place after the US, China, and Japan

Korea possesses a 6.9% share of the global market of the global gaming market. Korea ranked in the 4th place after the US, China, and Japan. Compared with the previous year, the Korean game market recorded double-digit growth in 2020, surpassing the UK, and rising from 5th to 4th place.

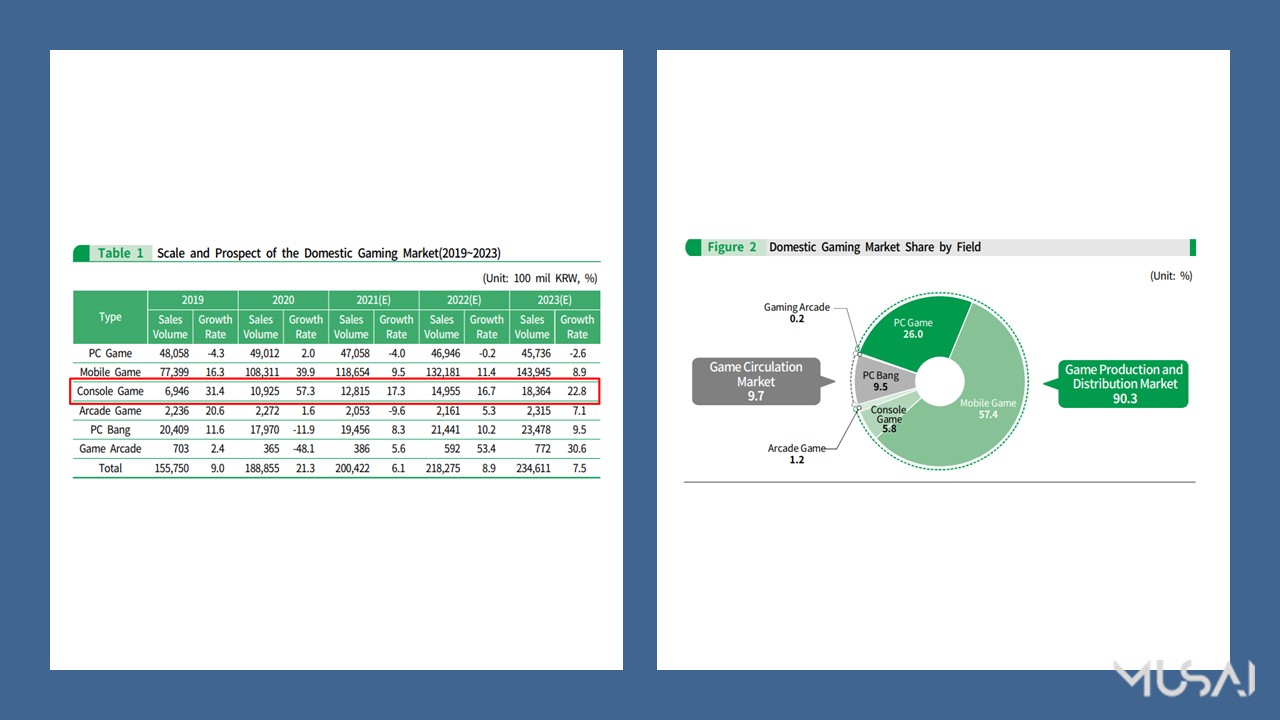

PC & Mobile platform accounts for the main market, but the Console market is growing steadily

As the COVID-19 pandemic continues in 2021, the game production and distribution markets are expected to continue to grow, focusing on mobile and console games. The number of new users in the mobile game sector has increased significantly. Moreover, due to its excellent accessibility, the mobile game market is expected to continue its growth in the future. In 2021, the size of the PC gaming market is expected to decrease by 4%, compared to 2020.

As for the console market, it is growing steadily every year and this trend will continue due to new console platforms and their exclusive game titles as well as the Covid-19 situation.

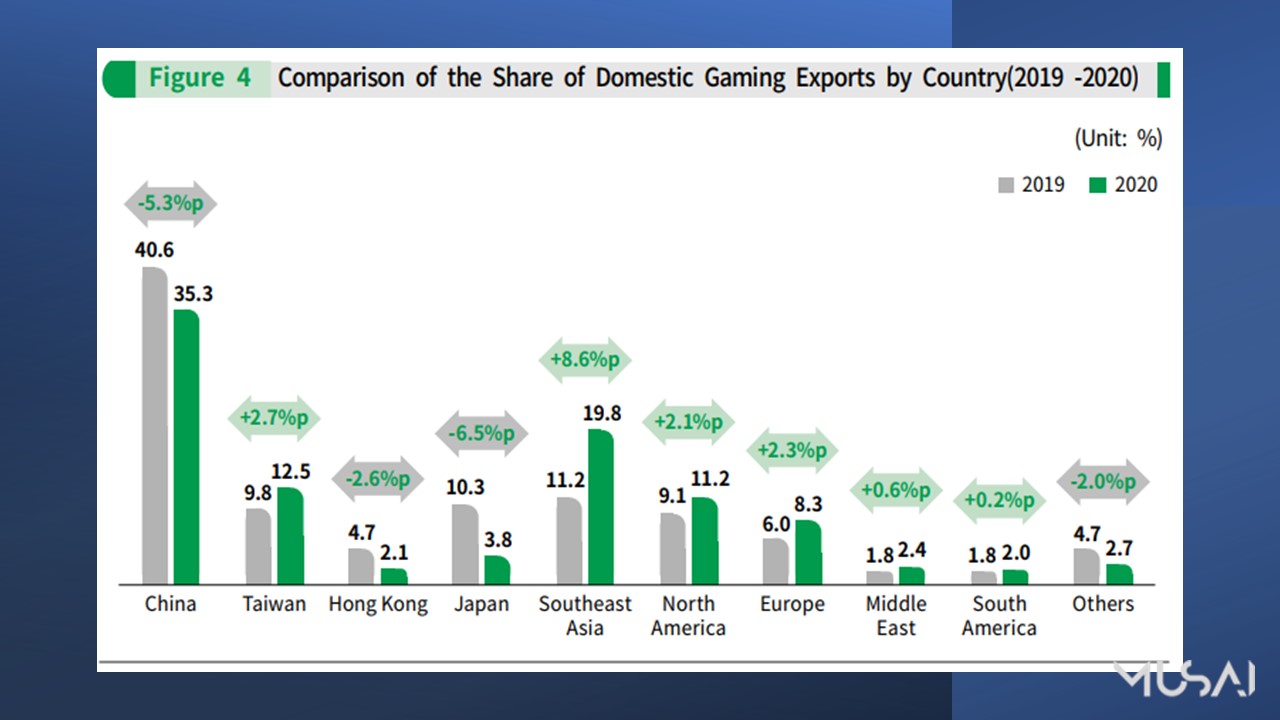

Which country plays Korean games the most?

In terms of the share of domestic gaming exports by country and region in 2020, the share of “China” was highest at 35.3%. This was followed by “Southeast Asia” with 19.8%, “Taiwan” with 12.5%, “North America” with 11.2%, and “Europe” with 8.3%. Comparing it to the previous year, the export share to “Southeast Asia” increased by 8.6%p, while the exports to “China” and “Japan” decreased by 5.3%p and 6.5%p, respectively.

Musai Studio is excited to share the insight provided within the 2021 Game White Paper, and celebrate the growth of the Korean game market.

A summary of the game white paper is also provided in English and can be downloaded in the link below:

https://welcon.kocca.kr/ko/info/trend/1951049

** Did you enjoy this article? Please click subscribe and share this story.

BOOST YOUR PLAY! Musai Studio